Unlisted infrastructure

Unlock opportunities and expand new horizons

What is unlisted infrastructure investing?

Infrastructure is the backbone of our society. It provides the essential services that we rely on every day, such as transportation, connectivity, energy, water, and sanitation. Infrastructure also plays a vital role in economic growth and development.

However, unlisted infrastructure remains underutilized as a diversifier. Traditional asset classes like equities and fixed income play crucial roles but are more susceptible to broader market volatilities and may be supplemented to meet the long-term return objectives of investors.

The global infrastructure landscape is diverse, encompassing transportation, utilities, and social infrastructure. Unlisted infrastructure within the broader infrastructure sector has a valuation surpassing $10 trillion and is expected to experience substantial growth. Key drivers include the need for enhanced energy efficiency, rising data demands, challenges in digital communications from changing work and lifestyle dynamics, and evolving demographics.

Benefits of investing in unlisted infrastructure

Diversification

As a real asset category, infrastructure offers a distinct risk, return, and diversification profile relative to other asset classes, and thus merits consideration for a discrete allocation in a diversified portfolio.

Income generation

Infrastructure investments typically feature steady cash flows derived from tangible, long-life assets with monopoly-like pricing power; many are regulated and may feature income linked directly to inflation.

Long-term return potential

Secular growth trends in renewables, digital and social. Business models that are effective at harvesting these long-term trends are difficult to access in the listed market.

Risk management

Managing risk across vintages and profiles

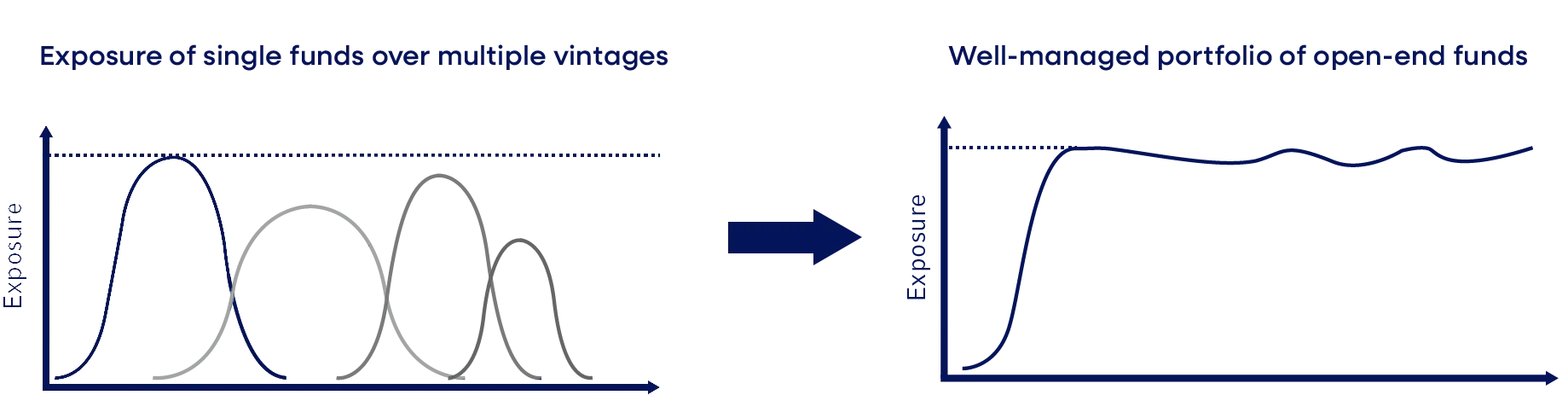

Creating an unlisted infrastructure portfolio requires investors to maintain the designated exposure in capital and strategic allocations. Closed-end funds, commonly used for this purpose, present challenges due to their fixed legal duration. Navigating commitments, predicting capital calls and distributions is complex, especially with unpredictable business scenarios and blind pool commitments. Closed-end funds' continuous asset changes disrupt portfolio diversification metrics, necessitating ongoing oversight. Conversely, an open-end fund structure provides a streamlined and less complex approach, alleviating these challenges.

Why Russell Investments for unlisted infrastructure?

Types of unlisted infrastructure assets

Our unlisted infrastructure solutions

Explore more alternative investment strategies

Partner with us

Get in touch with us through this form, and we'll reach out to you.